-

CPAs and

FiduciariesIRS-compliant estate, trust, and gift valuations with the clarity and credibility professionals need in high-value financial matters.

Book a discovery call

Get Started -

-

Estate & Trust

Appraisals -

Estate and trust valuations aren’t just about numbers—they directly impact tax

liability, basis calculations, and settlement outcomes. In the world of CPAs and

fiduciaries, appraisal choices determine whether you stand on solid ground or

shaky footing.-

General-purpose or lending-format reports (like a Fannie Mae 1004) are

not designed for estate and trust purposes. -

These reports often fail to meet the defensibility standards required if the

matter goes to IRS review, mediation, or court. -

Using the wrong report format can put your client - and your reputation - at risk.

Why Most Appraisals Fall Short

-

-

CPA-Centered

Solutions that Cut

Costs and Create

Impact -

Validox.RED provides many types of CPA-centered valuations including a

proprietary Restricted Use Appraisal Review Report built specifically for estate,

trust, and settlement matters. This best-selling report provides key benefits such as:-

Defensibility – designed to hold up under IRS, audit, or courtroom scrutiny.

-

Integrity-based Scope of Work- CPA’s and their clients get confirmation of the

quality of and adherence to Uniform Standards that govern appraisal integrity -

Risk Reduction – can assist in reducing risk exposure for CPAs, fiduciaries, and their clients.

-

The correct effective date (date of death, transfer, or other triggering event) is

critical. -

We deliver retrospective, current, or multiple valuations as needed to align with tax

and settlement requirements. -

Our reports rely on market data from the exact period required, ensuring accuracy

and compliance.

Each ValidoxRED valuation is built on comprehensive principles that withstand

scrutiny and support success.Whether you need a formal appraisal, a second opinion, or expert witness rebuttal testimony, Validox.red delivers valuations that are defensible, timely, and tailored to your case strategy. We understand the importance of clarity, independence, and precision in legal contexts and we bring those values to every engagement

-

-

Why Choose

Validox.RED? -

-

Litigation-tested expertise in real property damages and valuation disputes.

-

Reports that are accurate, credible, and persuasive—not just paperwork.

-

Our team specializes in simplifying and delivering valuation services that equip

CPAs with clear, actionable answers for their clients.

-

-

-

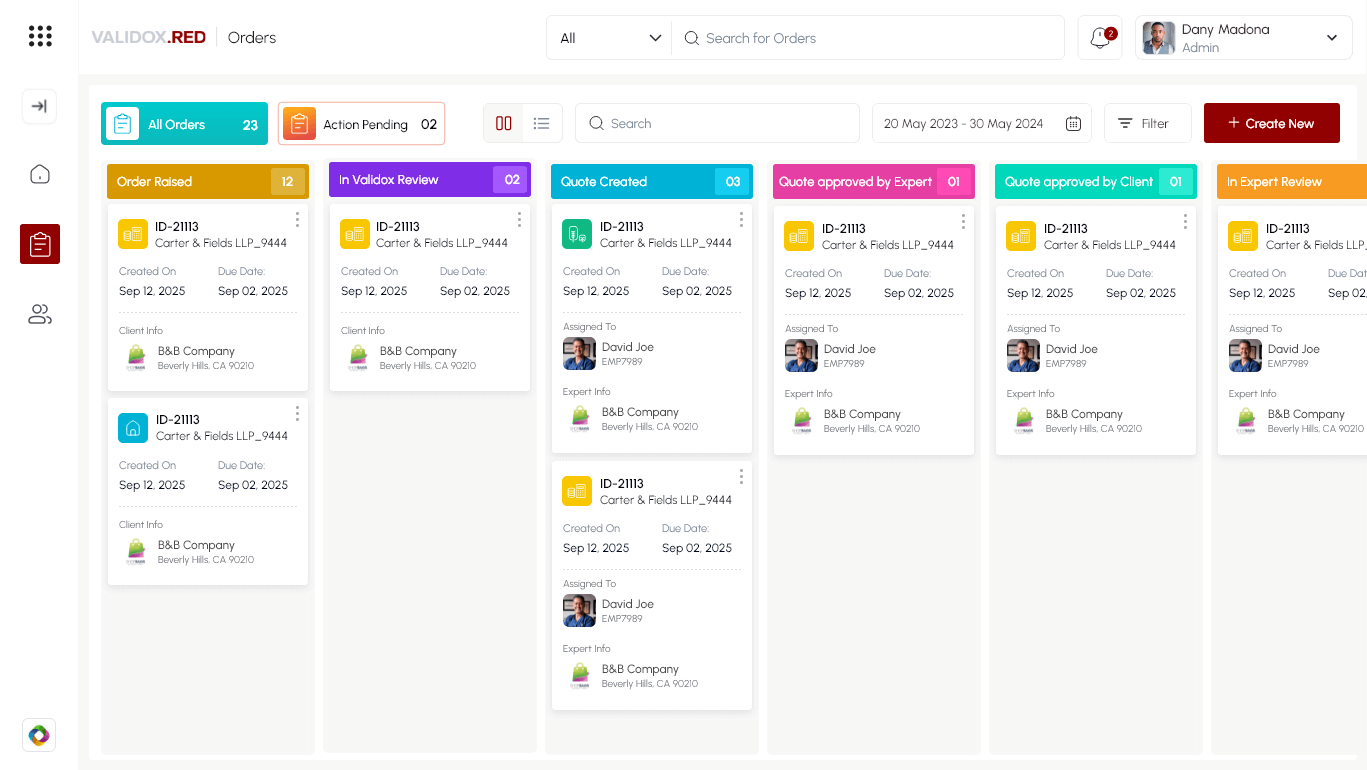

Validox.red platform

One Powerful Platform

Cut costs, reduce risk, and pass every audit with Validox, the single-source solution for valuation & appraiser compliance.

Explore Platform